Cheyenne Federal Credit Union: Dependable Financial Solutions for Your Demands

Wiki Article

Why Joining a Federal Lending Institution Is a Smart Option

Joining a Federal Debt Union represents a critical financial step with countless benefits that provide to individuals looking for a much more customized and community-oriented financial experience. By exploring the distinct offerings of Federal Credit rating Unions, individuals can tap right into a globe of economic empowerment and connection that goes beyond standard financial solutions.Reduced Charges and Competitive Rates

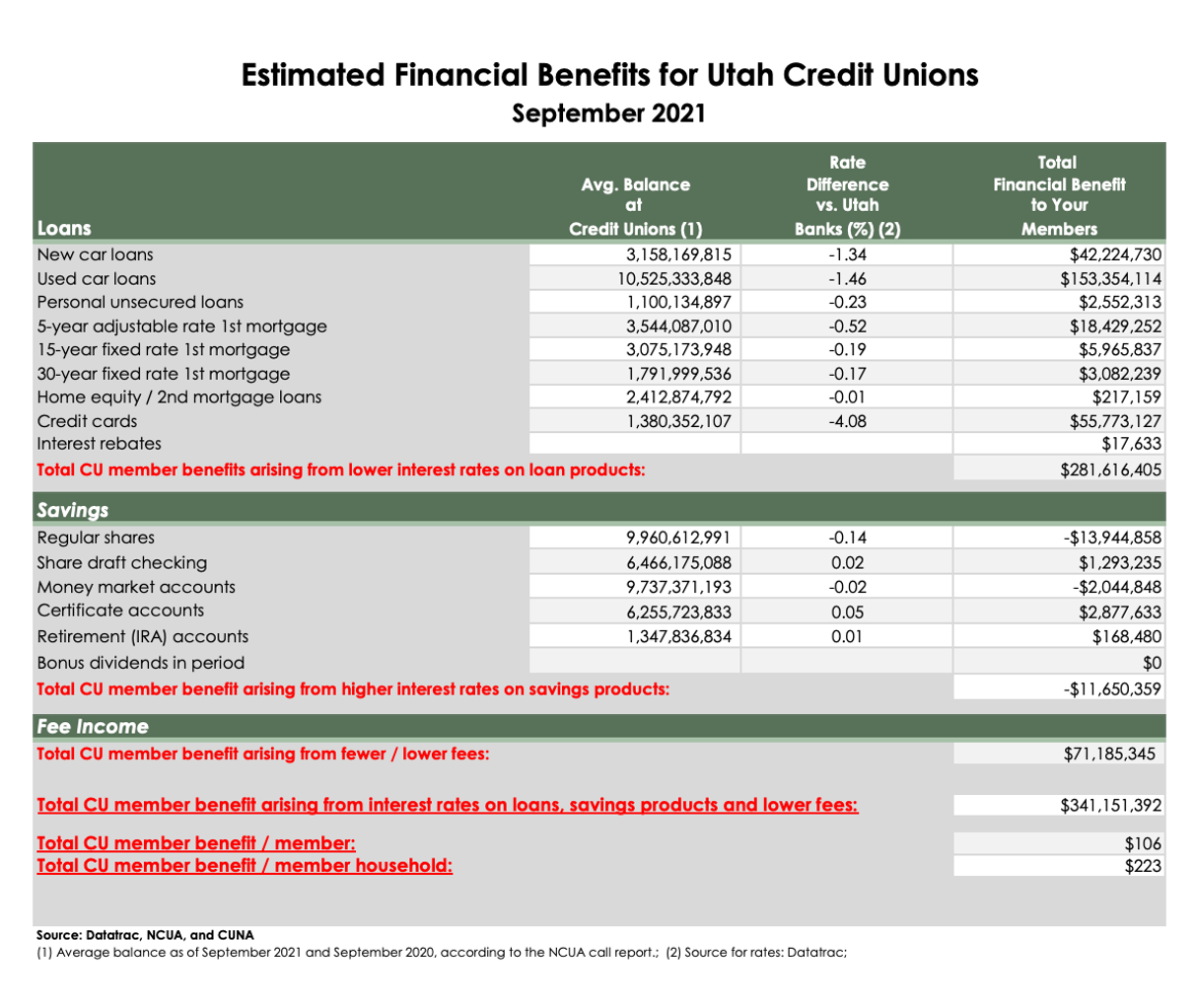

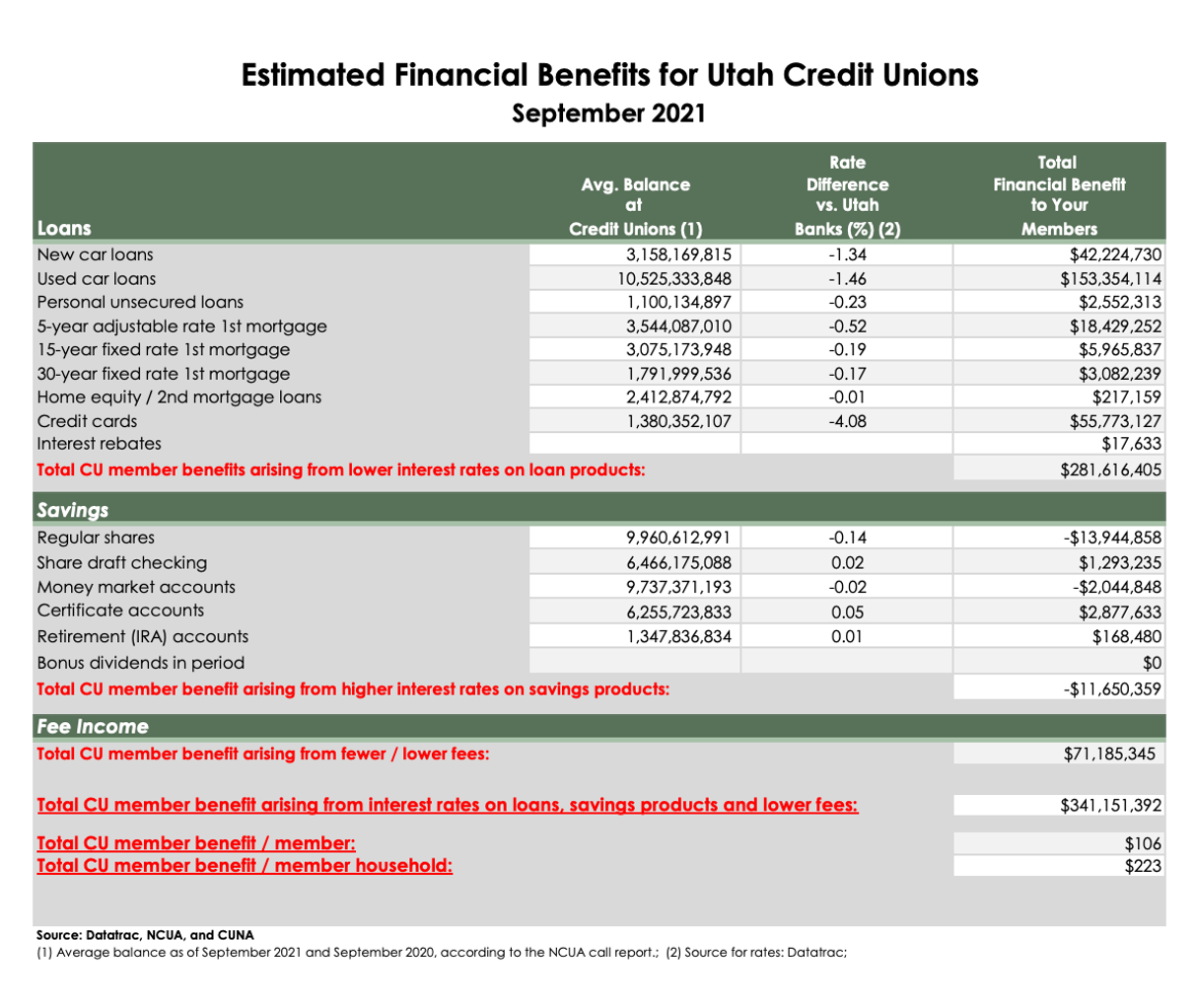

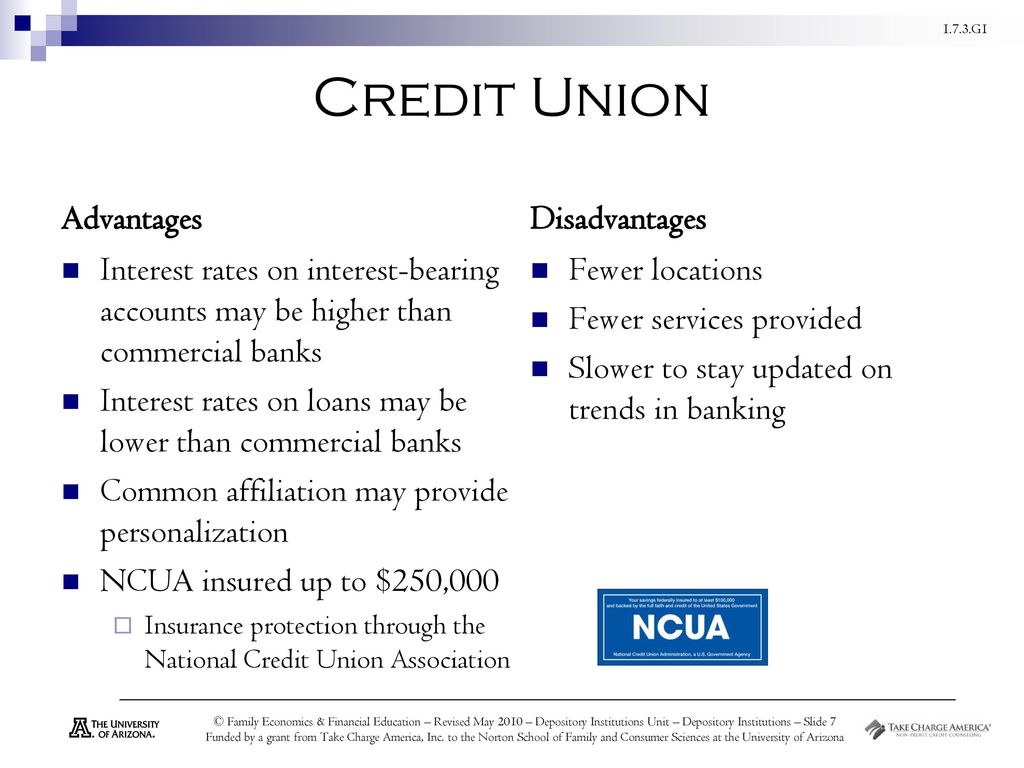

By prioritizing the financial well-being of their participants, credit history unions can use higher interest rates on savings items, assisting individuals grow their cash faster. On the borrowing side, credit history unions tend to have lower passion prices on finances, including mortgages, auto loans, and individual finances, making it a lot more cost effective for members to access credit when required.

Concentrate On Member Contentment

Federal cooperative credit union prioritize participant complete satisfaction by customizing their financial services and products to satisfy the one-of-a-kind requirements and choices of their members. Unlike standard financial institutions, federal credit unions operate as not-for-profit companies, permitting them to concentrate on supplying excellent service to their members instead of maximizing profits. When they communicate with credit report union team, this member-centric approach is apparent in the individualized interest members obtain. Whether it's opening a new account, applying for a funding, or looking for monetary recommendations, participants can anticipate encouraging and conscientious solution that intends to resolve their private monetary objectives.

By keeping the finest passions of their members at heart, debt unions create a much more fulfilling and positive banking experience. By picking to sign up with a federal credit score union, people can benefit from a financial organization that absolutely cares concerning their health and monetary success.

Community-Oriented Method

Emphasizing area interaction and local influence, federal cooperative credit union demonstrate a dedication to serving the needs of their bordering neighborhoods. Unlike typical financial institutions, federal credit unions operate as not-for-profit organizations, allowing them to concentrate on benefiting their areas and members instead than taking full advantage of profits. This community-oriented technique is evident in numerous aspects of their procedures.Federal lending institution typically prioritize using financial services customized to the specific requirements of the neighborhood neighborhood. By comprehending the unique obstacles and opportunities present in the areas they serve, these cooperative credit union can provide more easily accessible and personalized economic remedies. This targeted approach promotes a feeling of belonging and trust fund amongst community members, enhancing the bond in between the credit rating union and its constituents.

Furthermore, government cooperative credit union often take part in neighborhood growth campaigns, such as sustaining neighborhood businesses, sponsoring occasions, and advertising monetary proficiency programs. These initiatives not only contribute to the economic growth and stability of the community however likewise demonstrate the cooperative credit union's devotion to making a positive effect beyond just financial services. By proactively taking part in community-oriented tasks, government lending institution develop themselves as columns of support and advocacy within their communities.

Accessibility to Financial Education And Learning

With a focus on encouraging members with vital economic knowledge and abilities, federal debt unions prioritize supplying obtainable and extensive financial education programs. These programs are created to equip members with the tools they need to make educated choices concerning their finances, such as budgeting, saving, investing, and credit score management. By offering workshops, seminars, on the internet resources, and one-on-one counseling, federal credit score unions ensure that their members have access to a large range of academic chances.

Financial education is crucial in helping people navigate the complexities of individual money and accomplish their long-lasting monetary goals. Federal lending institution understand the importance of economic proficiency in advertising monetary wellness and stability among their participants. By supplying these educational resources, they encourage people to take control of their monetary futures and develop a strong structure for economic success.

Improved Client Service

Members of federal credit unions frequently experience a greater level of individualized service, as these establishments focus on individualized interest and assistance. Whether it's assisting with account administration, providing financial recommendations, or dealing with issues immediately, federal credit report unions aim to go beyond participant assumptions.One trick aspect of improved customer support in government cooperative credit union is the focus on structure long-term relationships with members. By making the effort to comprehend participants' economic goals and providing tailored options, credit unions can provide meaningful support that goes beyond transactional interactions. Additionally, federal lending institution normally have a solid neighborhood focus, additional improving the level of client service by fostering a sense of belonging and link amongst participants.

Final Thought

To conclude, joining a Federal Cooperative credit union provides countless benefits such as lower costs, affordable rates, customized service, and accessibility to economic education and learning (Credit Unions Cheyenne). With a focus on participant contentment and neighborhood engagement, lending institution focus on the monetary Credit Unions Cheyenne WY well-being of their participants. By selecting to be part of a Federal Cooperative credit union, people can take pleasure in a customer-centric method to financial that promotes strong area connections and encourages them to make enlightened monetary decisionsOn the loaning side, credit history unions tend to have reduced interest prices on car loans, including home loans, auto finances, and personal financings, making it much more budget-friendly for members to accessibility credit history when needed.Federal credit report unions prioritize member contentment by tailoring their financial items and solutions to meet the one-of-a-kind demands and choices of their participants.With a focus on equipping members with necessary financial understanding and skills, government credit unions focus on supplying thorough and accessible financial education programs. Federal credit rating unions comprehend the significance of financial literacy in promoting financial wellness and stability among their participants. With an emphasis on member contentment and area engagement, credit score unions prioritize the economic wellness of their participants.

Report this wiki page